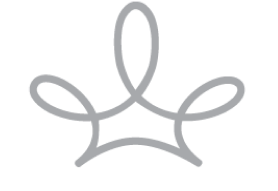

Be Recognized with Terryberry’s Employee Recognition Platform

Our employee platform offers tailorable recognition and reward solutions all in one place. It’s your software hub for everything you need to design and develop a recognition culture within your organization.

Why Choose Be Recognized for Employee Recognition?

The Be Recognized employee recognition software allows you to create an engaged, purpose-led organization through employee recognition, corporate wellness, custom awards, and analytics. Adaptable to meet your unique needs. Our employee recognition program is robust, yet user-friendly. The Be Platform truly is employee engagement simplified.

One Stop Shop

Our custom awards and jewelry are made in-house, allowing for a higher degree of customization

Scalable

Want your program to grow with you? Our scalable options allow users to start slow and ramp up over time.

Integrations

Our employee recognition platform integrates with popular workplace tools, like Slack, Microsoft Teams, Outlook, and many HRIS/HCM platforms.

Service Awards

- Recognize and celebrate employee anniversaries, achievements, and career milestones.

- Redeem from our selection of recognition awards and customized appreciation gifts.

- With in-house manufacturing and fulfillment, we’re able to offer highly customized awards quickly.

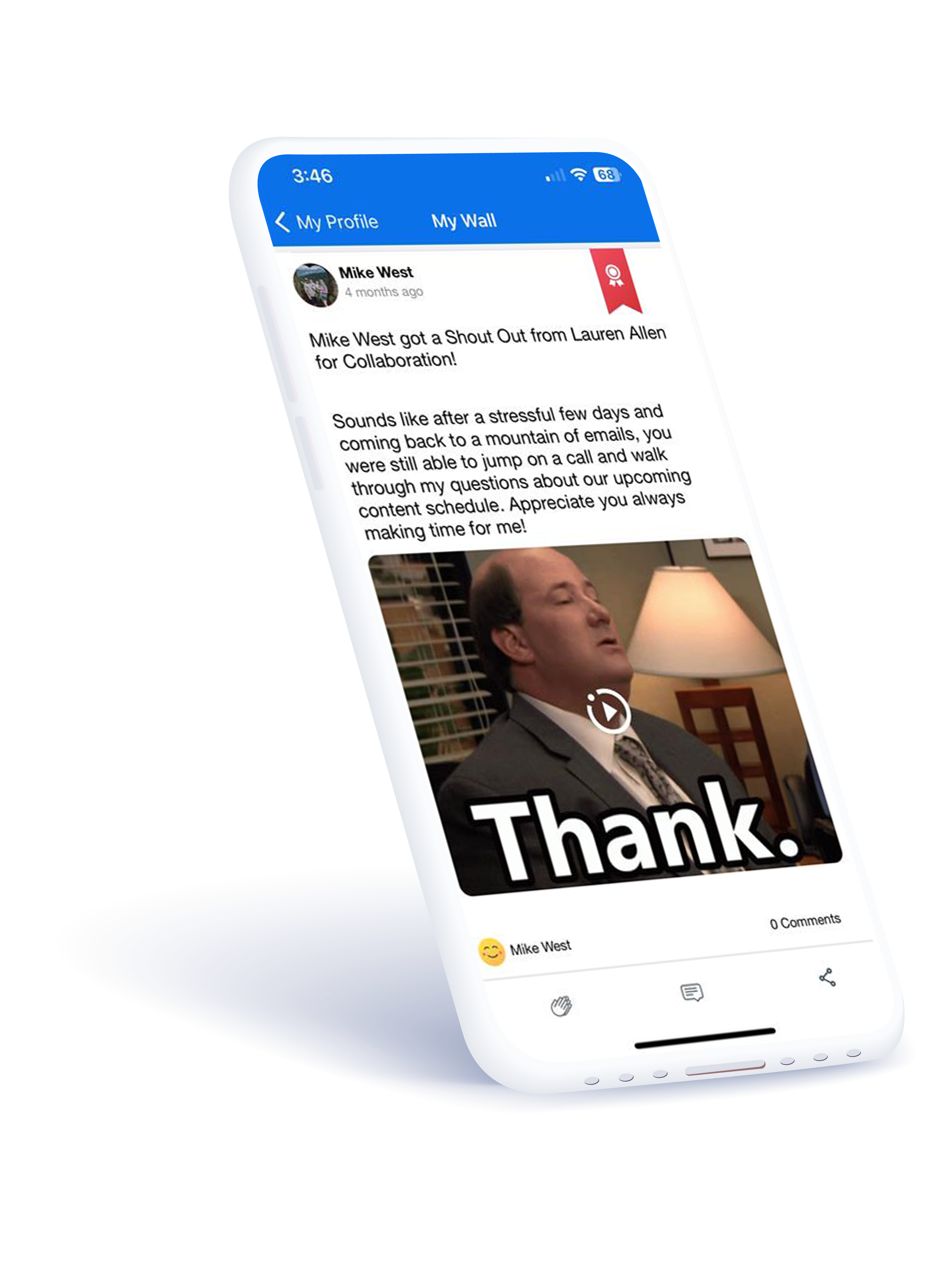

- With peer-to-peer recognition driven by your mission, vision, and values never miss another recognition moment again.

- Lead by example with manager spot recognition.

- Partner with Terryberry to build a recognition strategy tailored to your employees, your values, and your budget.

Employee Incentives

- Motivate and engage employees with sales, wellness, and safety incentives.

- Reward performance with points, shopping sprees, or custom awards that celebrate achievements.

- Partner with Terryberry to create customized competitive campaigns and programs.

FAQs

What is employee recognition software?

Employee recognition software is a type of technology designed to help organizations acknowledge

and reward the efforts and achievements of their employees. It provides a platform for managers and

colleagues to give positive feedback, recognize accomplishments, and celebrate milestones within

the workplace.

The software often includes features such as peer-to-peer recognition, rewards and incentives programs,

performance tracking, and analytics.